LTC Price Prediction: Can Litecoin Reach $200 Amid Bullish Technicals and ETF Hype?

#LTC

- Technical Breakout: LTC trades above all key moving averages with bullish MACD crossover

- ETF Catalyst: Speculation about Litecoin ETF approval fuels institutional interest

- Adoption Growth: Payment integration and mining innovations boost network utility

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

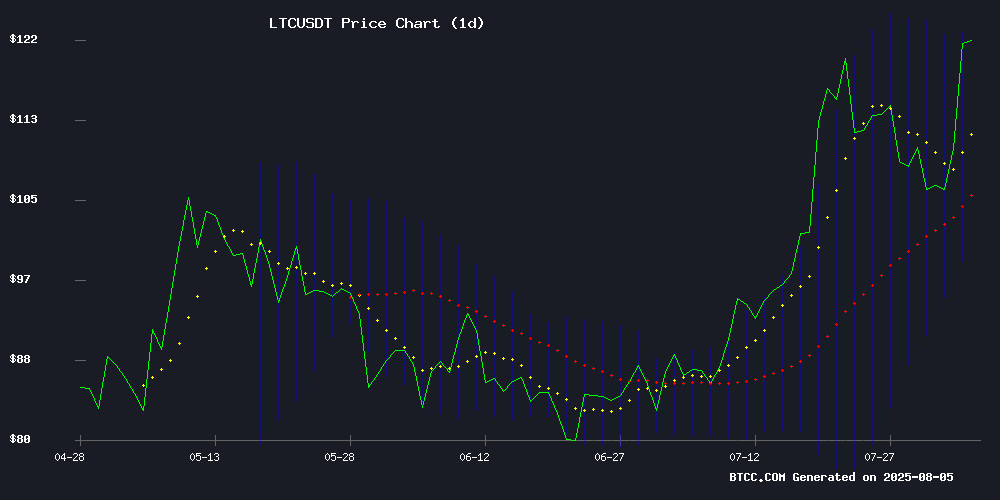

Litecoin (LTC) is currently trading at $128.20, significantly above its 20-day moving average (MA) of $112.08, indicating strong bullish momentum. The MACD histogram shows a positive crossover at 4.3094, reinforcing the upward trend. Bollinger Bands suggest volatility with the price NEAR the upper band at $124.67, while the middle band ($112.08) acts as support. According to BTCC financial analyst Ava, 'LTC's breakout above key resistance levels and positive technical indicators suggest potential for further upside.'

Litecoin Market Sentiment: ETF Hype and Adoption Drive Optimism

Recent headlines highlight Litecoin's 11% surge amid ETF speculation and growing merchant adoption. News of SolMining's free multi-crypto mining app and Litecoin breaking a 3-year consolidation pattern add to bullish sentiment. BTCC's Ava notes, 'The combination of institutional interest (via ETF rumors) and real-world payment use cases creates a perfect storm for LTC's price appreciation.' However, she cautions that activity metrics hitting 2-year lows could signal short-term overextension.

Factors Influencing LTC’s Price

Bitcoin Breaches $110K as Cloud Mining Emerges as 2025's Top Passive Income Trend

Bitcoin's sustained rally above $110,000 and Ripple's ascent toward $3 are forcing global investors to recalibrate their crypto strategies. The spotlight now shifts to cloud mining—projected to dominate passive income streams by mid-2025. ETHRANSACTION, a UK-based platform leveraging AI and clean energy, leads this charge with hardware-free mining for BTC, ETH, LTC, and DOGE via mobile devices.

ETHRANSACTION's $19 signup bonus and McAfee-verified security protocols are accelerating adoption across three continents. The platform's compliance framework and irregular payout structure cater to both retail and institutional miners seeking volatility-resistant yields.

Litecoin Surges Over 11% in 24 Hours: Key Drivers and Indicators

Litecoin (LTC) has surged more than 11% in the past 24 hours, breaking above $123 as investor interest shifts toward major altcoins and speculation grows around a potential spot ETF approval. The cryptocurrency now leads weekly gains among the top 100 digital assets, reinforcing its market position.

Regulatory tailwinds are fueling the rally. The SEC's delayed decision on Grayscale's Litecoin ETF application—now expected by October—has Bloomberg analysts pricing in a 90% approval likelihood. Litecoin's classification as a commodity by the CFTC provides legal clarity, placing it alongside Bitcoin and Ethereum as lower-risk institutional bets. An ETF greenlight could unlock significant capital inflows.

Technical and fundamental factors align for continued momentum. Commercial adoption is accelerating, with payment processors and merchants increasingly integrating LTC. The asset's historical correlation with Bitcoin's halving cycles suggests potential upside as the next event approaches.

SolMining Launches Free Multi-Cryptocurrency Mining App

SolMining, a UK-registered cloud mining provider, has introduced a mobile app enabling users to mine Bitcoin (BTC), Dogecoin (DOGE), Litecoin (LTC), Ethereum (ETH), and XRP without hardware or technical setup. The platform offers a seamless entry into passive crypto income, targeting both novice and experienced users.

Users can register in under a minute, receiving a $15 bonus to purchase initial contracts. The app features tiered investment options with fixed returns, ranging from a $100 starter contract yielding $107 in two days to a $55,000 pro contract with a 40-day term. Earnings are automatically credited daily, with principal returned upon contract expiration.

The move comes as cloud mining gains traction among retail investors seeking exposure to crypto assets without operational complexities. SolMining's multi-currency support and compound interest options position it as a contender in the competitive mining-as-a-service sector.

Litecoin Breaks Three-Year Consolidation Pattern Amid Surging Payment Adoption

Litecoin's price surged 10.85% in 24 hours, breaking free from a prolonged sideways trend and reaching $122.85. The cryptocurrency surpassed its $110.70 resistance level, now acting as support, with trading volume spiking 170% to $1.48 billion.

Payment processor CoinGate reports Litecoin now commands 14.5% of crypto payments, trailing only Bitcoin's 22.9% market share. The network processed its 340 millionth transaction, with 12% occurring in 2025 alone.

Institutional interest grows as ETF approval odds hit 80%, despite overbought conditions signaled by an RSI of 80.31. The breakout reflects strengthening fundamentals in both trading and real-world use cases.

Top 10 Most Trusted Free Cloud Mining Platforms in 2025

The cryptocurrency mining landscape continues to evolve, with cloud mining emerging as a popular avenue for passive income generation. As institutional and retail interest grows, platforms are increasingly leveraging AI and sustainable energy solutions to enhance efficiency.

Cryptosolo leads the pack with its multi-coin support and 8.8% ROI promise, while established players like NiceHash and BitDeer maintain market share through specialized offerings. The sector's maturation is evident in features like transparent contracts and 24/7 support becoming standard expectations.

Notably, the integration of browser-based mining and altcoin conversion options reflects the industry's adaptation to diverse user needs. These developments occur against a backdrop of rising Bitcoin adoption, making accessibility and security paramount concerns for platform operators.

Litecoin Surges 11% on ETF Speculation and Merchant Adoption

Litecoin (LTC) rallied more than 11% in 24 hours, breaching $123 as traders rotated into legacy altcoins amid improving market sentiment and renewed spot ETF speculation. The token now leads weekly gains among top-100 cryptocurrencies, fueled by structural adoption and regulatory tailwinds.

CoinGate data reveals LTC accounted for 14.5% of July's crypto payments, surpassing stablecoins to become the second-most used asset after Bitcoin. This merchant adoption coincides with growing institutional interest—MEI Pharma recently allocated $100 million to Litecoin, mirroring early corporate Bitcoin treasury strategies.

Regulatory developments amplify the momentum. Bloomberg analysts assign 90% approval odds for a potential LTC ETF, citing the CFTC's commodity classification that places Litecoin alongside Bitcoin and Ethereum in regulatory clarity. The SEC has delayed its decision on Grayscale's application until October.

Technicals suggest room for continuation. LTC cleared its 7-day moving average with RSI at 69.5—elevated but not yet overbought. The $117.61 level now serves as critical support.

Litecoin Price Prediction – Can LTC Hit $131 Before Weekly Close?

Litecoin has emerged from consolidation to lead the altcoin rally, with a 10.85% gain in the past 24 hours and a 12.73% weekly surge. Trading at $122.85, its market cap now stands at $9.35 billion, while 24-hour volume spiked 170% to $1.48 billion. The rally is fueled by rising network activity, ETF speculation, and a technical breakout above the $110.70 resistance level.

On-chain data reveals Litecoin processed 300 million transactions since early January 2025, accounting for 12% of all LTC transactions since 2011. The 4-hour chart shows Bollinger Band expansion, with price hugging the upper band at $122.94. An RSI of 80.31 signals overbought conditions, yet bullish momentum persists.

Litecoin’s $120 Support Under Pressure—Springboard to $150 or Breakdown Ahead?

Litecoin (LTC) hovers precariously above the $120 support level, a critical threshold that could dictate its near-term trajectory. Recent bullish momentum has pushed the price past $114, but resistance is mounting. Holding $120 may propel LTC toward $135–$150, while a failure could trigger a pullback.

Market sentiment is intensifying as traders position themselves ahead of a potential SEC ETF approval for Litecoin, now estimated at 95% odds. Nearly 12% of all LTC transactions since inception occurred in 2025, signaling renewed interest.

Technically, LTC is confined within a symmetrical triangle pattern. A breakout could challenge the $140 resistance, though the $150 level remains a formidable barrier. The coming days will reveal whether Litecoin can sustain its rally or enter a cooldown phase.

AIXA Miner Emerges as a Leader in Cloud Mining for 2025

The crypto mining sector is undergoing a transformation as digital economies expand, with cloud mining emerging as the dominant trend for 2025. AIXA Miner has positioned itself as a standout platform, offering accessibility to a broad audience—from students to high-net-worth investors—seeking exposure to cryptocurrencies like BTC, ETH, DOGE, and LTC without the complexities of hardware setup.

Bitcoin's rebound above $80,000, fueled by positive ETF developments and Ethereum's "Pectra" upgrade, has intensified investor interest in passive entry points. Cloud mining platforms like AIXA Miner capitalize on this bullish momentum by eliminating the need for technical expertise or significant capital outlays.

Traditional mining's heavy infrastructure demands contrast sharply with cloud mining's remote, cost-efficient model. AIXA Miner abstracts away hardware maintenance, energy costs, and hash rate volatility—delivering mining as a seamless service. This shift aligns with institutional adoption trends and retail demand for frictionless crypto participation.

XRP Dips Below $3 as Investors Shift to ZA Miner's Cloud Mining Platform

XRP has declined nearly 5% in the past 24 hours, slipping below the $3 threshold to $2.83 as of August 3. The drop follows heightened sell pressure and lingering legal uncertainties surrounding Ripple. While some traders view this as a temporary correction, long-term holders are reminded of crypto's inherent volatility.

Rather than weathering the storm, many investors are migrating funds to ZA Miner's Bitcoin cloud mining platform. The service offers daily passive income without requiring active trading, hardware ownership, or exposure to market swings. Since its 2020 launch, ZA Miner has democratized mining with entry points as low as $100, supporting BTC, ETH, DOGE, and LTC earnings.

The FCA-regulated platform operates over 100 renewable-powered facilities globally, secured by McAfee® and Cloudflare®. XRP holders are particularly leveraging short-duration mining contracts, balancing their portfolios between speculative assets and steady yield generation.

Litecoin Activity Hits 2-Year Low as Remittix Presale Gains Momentum

Litecoin's network activity has plummeted to its lowest level in two years, signaling waning interest in the legacy cryptocurrency. The LTC price remains stagnant at $108.33, trapped in a narrow trading range despite technical analysts identifying potential upside. Market participants appear increasingly disinterested in Litecoin's muted price action, even as some maintain bullish price targets near $150.

Meanwhile, Remittix is capturing market attention with record-breaking daily volume in its ongoing presale. The payment-focused DeFi project demonstrates that real-world utility continues to drive investor demand in 2025's competitive crypto landscape. The contrast highlights a market shift favoring innovative protocols over aging assets lacking compelling use cases.

Will LTC Price Hit 200?

While LTC shows strong technical and fundamental momentum, reaching $200 would require a 56% surge from current levels ($128.20). Key factors to watch:

| Key Level | Price | Significance |

|---|---|---|

| Immediate Resistance | $131 | Weekly close target |

| Breakout Zone | $150 | 2025 high |

| Support | $120 | Critical hold |

BTCC's Ava suggests: 'The $150 level must be decisively broken before $200 becomes plausible. Current technicals support gradual appreciation, but macroeconomic conditions and Bitcoin's dominance will play determining roles.'